It feels like another lifetime ago that I wrote The FANGification of U.S Cannabis but in reality, it was late September 19, er, 2020. Things weren’t half bad for the emerging U.S canna industry, all things considered. They, and those of us invested in them, had just endured a harrowing stretch that helped shape The Anatomy of the Turn and set forth this course of secular growth.

Meanwhile, U.S operators, against all odds and despite medieval-level custody f*ckery in Q419 / Q120 that required third-level maneuvering / steely-nerved resolve / Teflon determination to withstand the wretched stench of coordinated / antiquated agendas…

…with the 70-odd percent effective tax rates; no banking services; onerous A.G’s; life-threatening security risks (still); despite ALL that and so much more, these pioneering success stories kept on keeping on because they had no choice. Which brings us back, way back, to when we first fingered the Fab Four eleven months ago.

I’m not gonna regurgitate how four primary metrics often determine the success of an investment bc 1) I did that last November in The United States of Cannabis, 2) I abhor redundancy / view it as a sign of intellectual weakness and 3) I’m, uh, refreshing those metrics next week for our monthly CB1 Letter to Investors (LTI).

Still and as discussed, we lost the technical metric last month as several leaders—and U.S cannabis ETF $MSOS—lost their 200-day moving averages on the daily charts…

There’s no putting lipstick on that that pigly chart bc price doesn’t lie, the reaction to news is always more important than the news itself and the market is never wrong. And trust me, I’ve spent countless hours sticking a fork in our thesis, poking holes in the bull case and attempting to scratch that ever-elusive itch: what the f*ck am I missing?

Maybe earnings would shed light? Curaleaf started us Monday and Bojo, Joba & Co. crushed it, particularly given it was a mulligan quarter as the economy reopened and a share-of-wallet transitioned to travel / dining. But wait, maybe everyone was high?

They guided annual revs to $1.2B-$1.3B (an Apple-esque sandbag) while expecting NJ to come online in late ‘21, CT in 2H22, and NY the first half of 2023 (+ PA / MD). Also, check that weekly chart as we emerge from the seasonally soft summer.

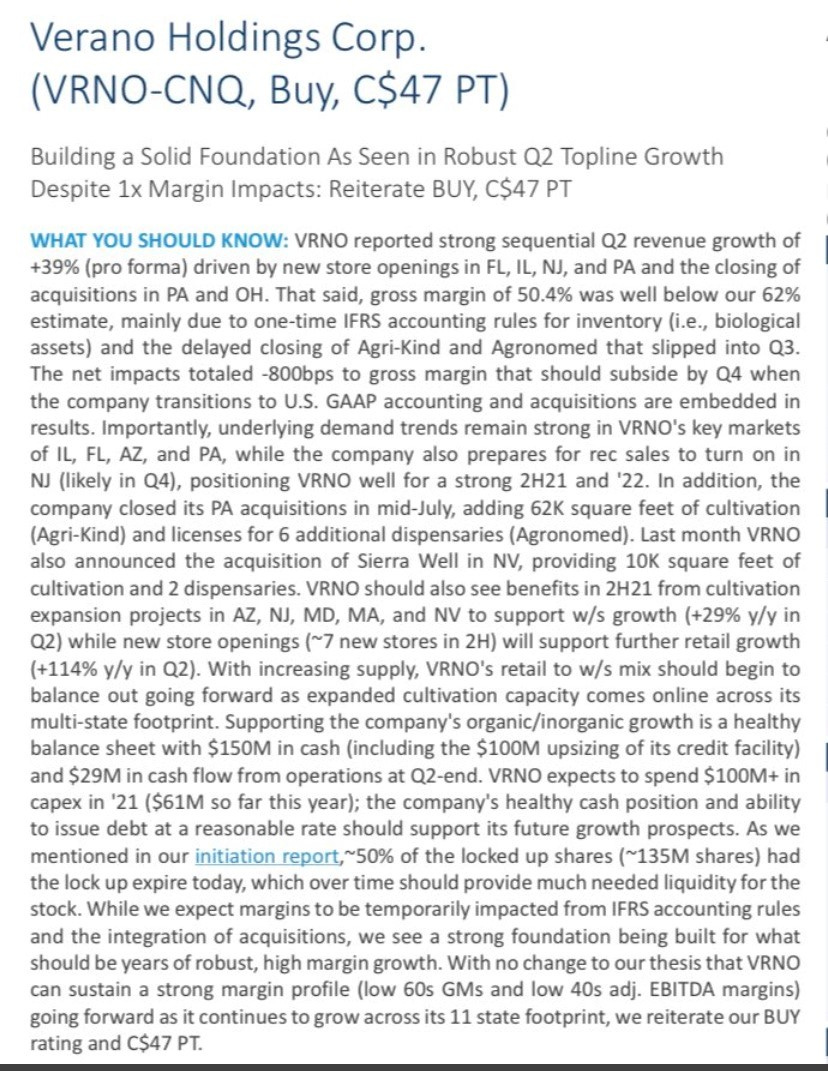

Verano Cannabis released Tuesday and if you don’t know this name…

…it’s likely bc it came public February at the cyclical top right after U.S cannabis ETF $MSOS put a billy to work across the space. We’ve discussed how this may be the extra “A” in FAANG, how it’s discounted to an already discounted peer group, and how Dr. RosenRosen may soon use his whole fist. But yeah, they reported Tuesday too…

…and while naked shorts continue to lean against the coming block of insider stock—which we expect to resolve this morning, hopefully w/o the scummers covering on the print—the sharper cats on the Street, such as Camilo (Iron like a) Lyon (in Zion) see it:

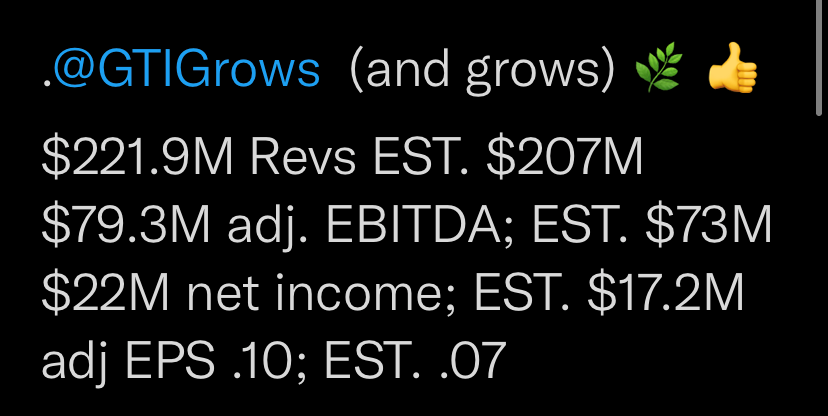

Green Thumb was up next and that bar was jacked nice and high for Big Ben but…

…he cleared it w room to spare. This is the best chart of all of canna FAANG / the stock trades at a premium to the group but as long as they continue to be fierce stewards of capital / demonstrate their impressive commitment to excellence, it will be warranted.

Trulieve followed yesterday with some buff numbers of their own…

…and while margins contracted, the other side of that ride, or multiple expansion, is on the horizon, particularly once the Harvest deal closes, as Needham’s Matt “Shooter’ McGinley noted to his clients as he affirmed his $68.25 U.S price target.

And finally, Charlie and his Cannabis Factory delivered earnings w our coffee this AM:

They affirmed revenue run-rate guidance of $1B, upsized their credit facility by $200M (to $400M) and reduced the i-rate to 9.5% (imagine that). The conference call is in a bit but it looks like a solid end to a strong week of earnings for the new-fangled five-letter FAANG coming soon to an MSM near you.

The fabulous fundies will be featured again next week when fan favorite Terrascend ($TRSSF), led by Jason (born to be) Wild, and up-and-comer Ayr Wellness ($AYRWF) step to the stage, and if you’re picking up a theme in our coverage, or which stocks I highlight on here and through Twitter, it’s not an accident.

Because as brutal as these last six months have been, we continue to believe that we’re in the eye of the upside storm; and as traders vote on the short-term, investors would be wise to view this generational opportunity through a longer-term lens because the script is the script is the script.

What do I mean by that? We’ve been of the view that 1) this is a state-led story, which has been an upside surprise in 2021, 2) federal progress will be incremental, a scenario seemingly supported when the White House confirmed that it’s exploring clemency for federal drug crimes (the “+” that’ll affix to SAFE later this / early next year), and 3) this latest malaise is a cyclical bear within a secular bull. And for that reason…

Note: while our July LTI will publish next week, this will be the last substack of the summer as I plan to take some family time the last week of August.

May peace be with you.

/positions in stocks mentioned

/advisor $MSOS